The Tension Between Two Goals

Traditional debt payoff advice focuses on minimizing interest and getting to $0 as fast as possible. That's financially optimal. But credit scoring doesn't care about what's optimal for you. It cares about specific factors that sometimes conflict with aggressive debt payoff.

For example, paying off a credit card entirely is great for your wallet. But it might lower your credit score temporarily if it changes your credit utilization or closes an account. Does that matter? It depends on what you're planning to do.

When Credit Score Matters More

If you're planning to apply for a mortgage, auto loan, or apartment in the next 6-12 months, your credit score matters a lot. A few points can mean thousands of dollars in interest over the life of a loan.

In these cases, you might want to be strategic about which debts you pay first. Paying down credit cards to lower your utilization ratio (ideally under 30%, better under 10%) can have an immediate positive impact on your score.

When Debt Freedom Wins

If you're not planning any major credit applications in the near future, don't overthink it. The mathematically optimal debt payoff approach (avalanche method) will usually serve you well.

- No big purchases requiring credit coming up? Focus on debt freedom.

- High-interest debt? Attack it aggressively.

- Your score will recover and improve as debt decreases.

- Being debt-free matters more than a perfect score.

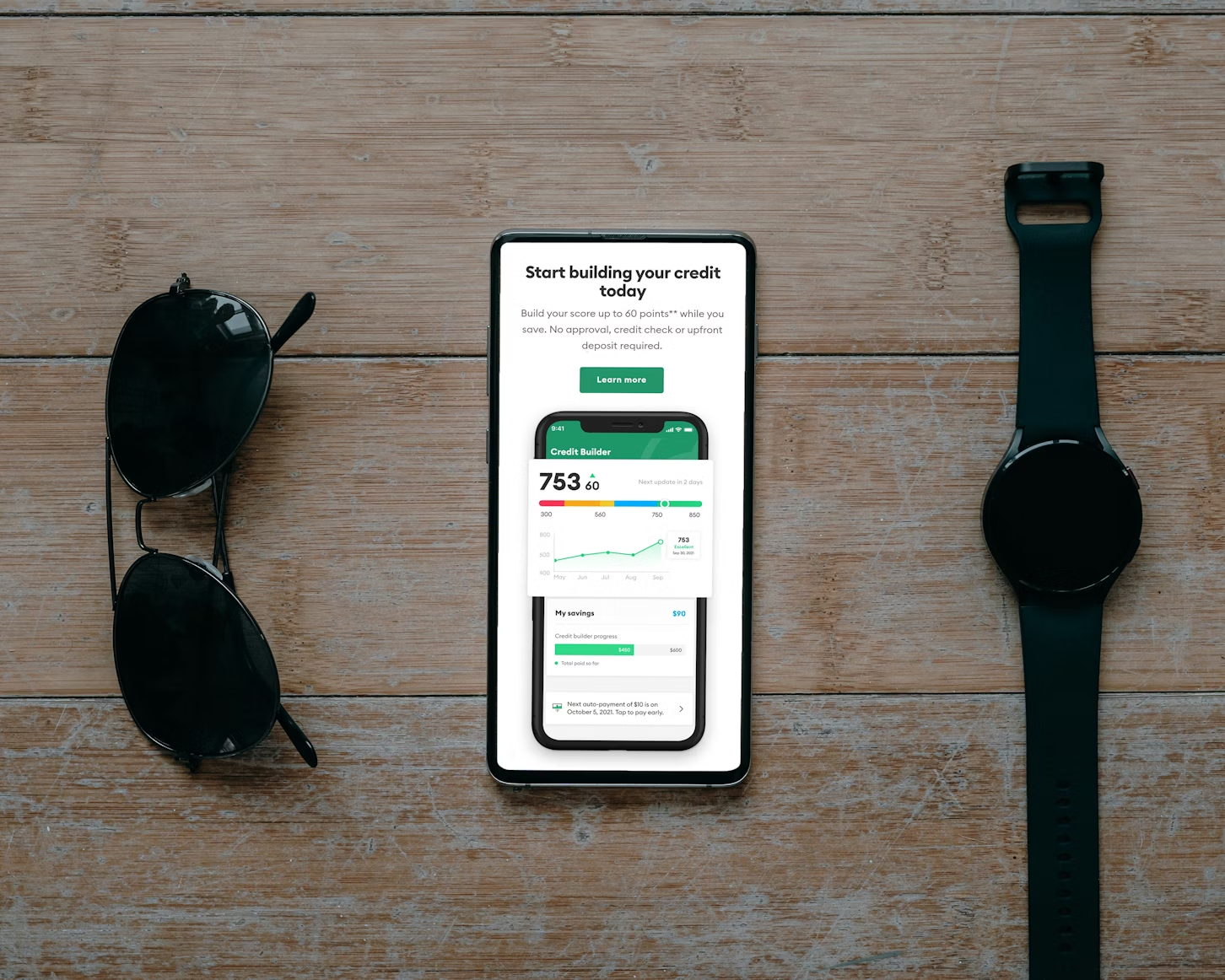

Spendify's Debt Planner includes a Credit Score Focus strategy for situations where you need to optimize for utilization. Use it when you need it, skip it when you don't.

The Long View

Here's the truth: people who are debt-free generally have great credit scores. The best thing you can do for your long-term credit health is get out of debt and stay out. Everything else is tactics.

.avif)